tax sheltered annuity taxation

The taxation on your retirement benefits varies whether you are a full-year resident nonresident or part-year resident of Wisconsin. We break down how annuities work annuity types downsides and alternatives to consider.

Learn About Retirement Income And Annuity Tax H R Block

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

. Annuities are often complex retirement investment products. Its similar to a 401 k plan maintained by a for-profit entity. Annuity Taxes for Surviving Spouses.

As mentioned Tax Sheltered Annuities or TSA is a savings program that allows employees or individuals to make contributions from their pre-tax income and put into a retirement plan. A tax-sheltered annuity plan gives employees. Learn some startling facts.

The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. Annuities are taxed at the time of withdrawal regardless of the. If you are a full-year resident of Wisconsin generally the.

Ad Discover Which Type Of Annuity Is Best Suited For Your Financial Strategy. Taxes are due once money is withdrawn from the annuity. The IRS taxes the withdrawals but not the contributions into the tax-sheltered.

A tax-sheltered annuity allows employees to invest income before taxes into a retirement plan. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity. Take a Closer Look at the Main Types of Annuities Common FAQs.

If you choose a direct transfer follow up with your new IRA plan custodian in a few weeks to make sure the transfer took. Ad Learn the pros and cons of annuities and why an annuity may not be a good investment. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities.

Of course this is assuming you have a pre-tax annuity. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. Complete any forms required by your 403 b plan administrator.

13 Retirement Investment Blunders. Ad Get this must-read guide if you are considering investing in annuities. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt. Ad Save for Your Retirement with a Tax-Deferred Annuity from Fidelity. Ad Read the Other Advantages an Annuity Provides How You Can Benefit from One Today.

Generally the best way for surviving spouses to minimize tax liability on an.

What Are Tax Sheltered Investments Types Risks Benefits

Annuity Taxation How Various Annuities Are Taxed

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What Is A Tax Deferred Annuity

What Is A Tax Sheltered Annuity Due

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Sheltered Annuity Faqs Employee Benefits

Annuity Tax Schedule Annuities Retirement Planning

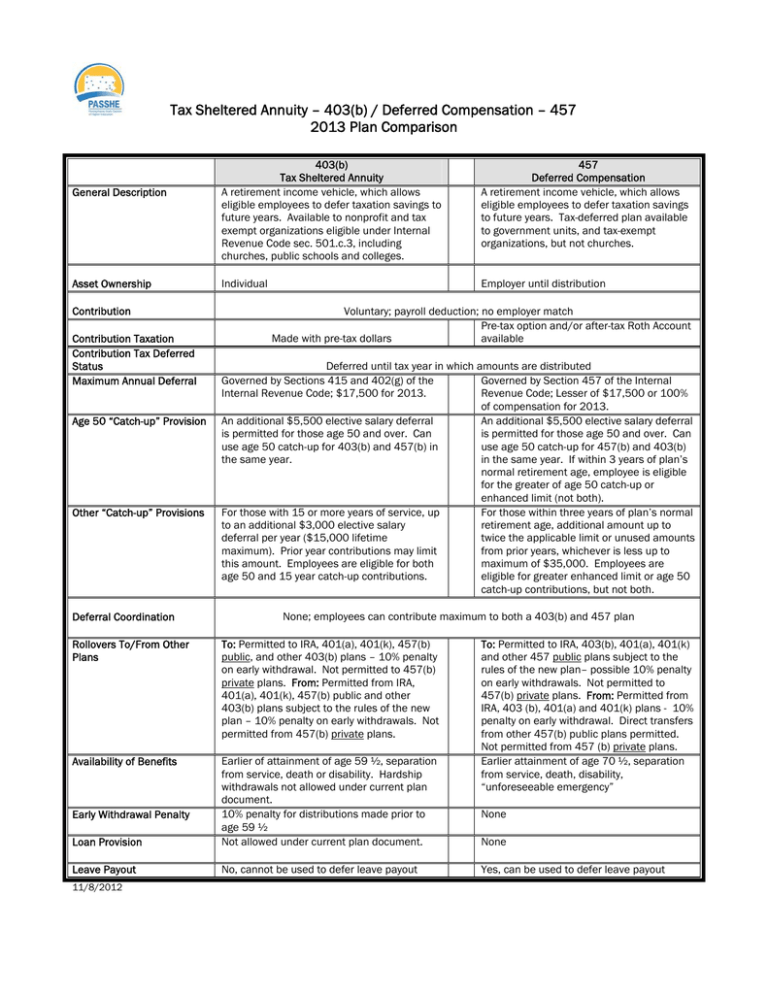

Tax Sheltered Annuity 403 B Deferred Compensation 457

What Is The Benefit Of Tax Deferred Growth Great American Insurance

How To Avoid Paying Taxes On Annuities Due

Annuity Taxation How Various Annuities Are Taxed

The Tax Sheltered Annuity Tsa 403 B Plan

Qualified Vs Non Qualified Annuities Taxation And Distribution