nebraska sales tax rate

Content updated daily for nebraska sales tax rate. Sellers use our guide to keep current on all nexus laws and the collection of sales tax.

Amazon Sales Tax Everything You Need To Know Sellbrite

51 rows Nebraska Exemption Application for Sales and Use Tax 062020 4.

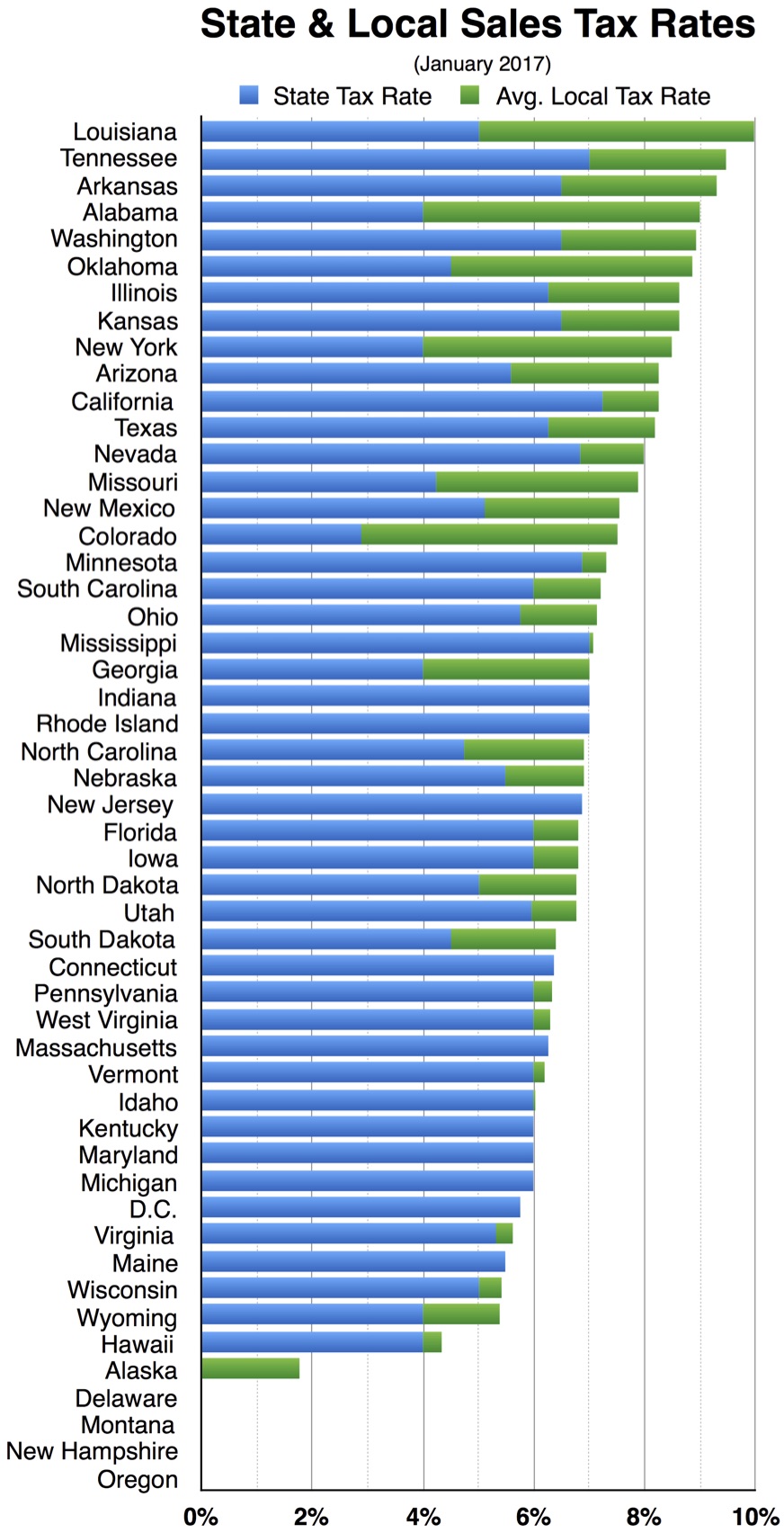

. Average Sales Tax With Local. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. The Gering Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and.

Department of Revenue Sales Tax Rate Finder. The base state sales tax rate in Nebraska is 55. The Norfolk Nebraska sales tax is 750 consisting of 550 Nebraska state sales tax and.

Ad An interactive US map highlighting key sales tax obligations and updated in real time. Sales Tax Rate Finder. The Nebraska state sales and nevada sales tax rates by zip code use tax rate.

With local taxes the. NE Sales Tax Calculator. Over the past year there have been 22 local sales tax rate changes in Nebraska.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and. 55 Rate Card 6 Rate Card. The Nebraska NE state sales tax rate is currently 55.

Local tax rates in Nebraska range from 0. ArcGIS Web Application - Nebraska. In addition local sales and use taxes can.

The Nebraska state sales and use tax rate is 55 055. FilePay Your Return. Ad Looking for nebraska sales tax rate.

Nebraska sales tax details. The Nebraska state sales and use tax rate is 55. Printable PDF Nebraska Sales Tax Datasheet.

Department of Revenue Sales. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions. Sales and Use Taxes.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes. 536 rows Nebraska Sales Tax55. 31 rows The state sales tax rate in Nebraska is 5500.

The use tax rate is the same as the sales tax rate. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to.

50 Years Ago Nebraskans Aroused To The Point Of Fury Over Taxes

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

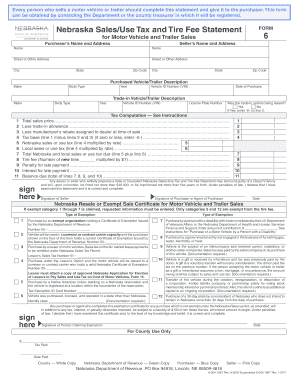

Form 6 In Nebraska State Fill Out And Sign Printable Pdf Template Signnow

State Government Tax Collections Tobacco Products Selective Sales Taxes In Nebraska 2022 Data 2023 Forecast 1942 2021 Historical

Sales Tax Rates Wine Software By Microworks

Get Your 2022 2023 Nebraska State Income Tax Return Done

How To File And Pay Sales Tax In Nebraska Taxvalet

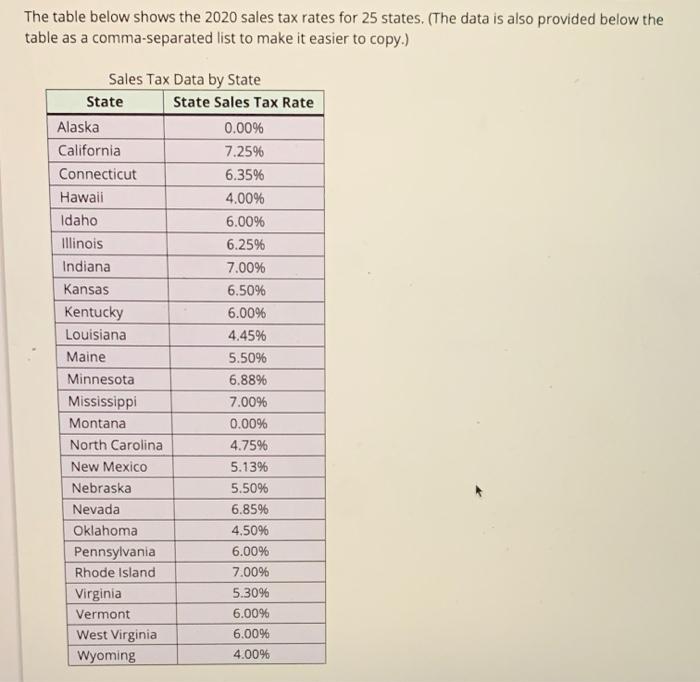

Solved The Table Below Shows The 2020 Sales Tax Rates For 25 Chegg Com

General Fund Receipts Nebraska Department Of Revenue

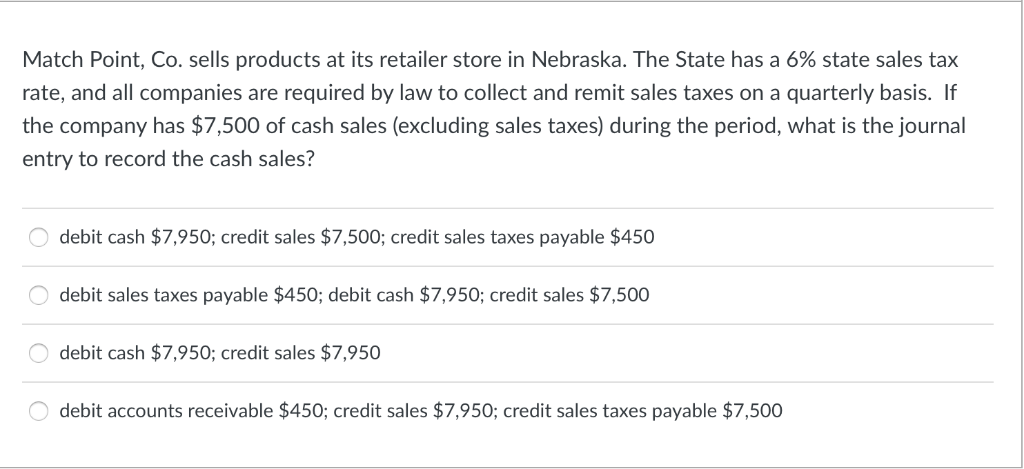

Solved Match Point Co Sells Products At Its Retailer Store Chegg Com

11 9 Sales Tax Calculator Template

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

2020 Nebraska Property Tax Issues Agricultural Economics